Jiji’s Playbook: How This Marketplace Hit 12M Users in 10 years

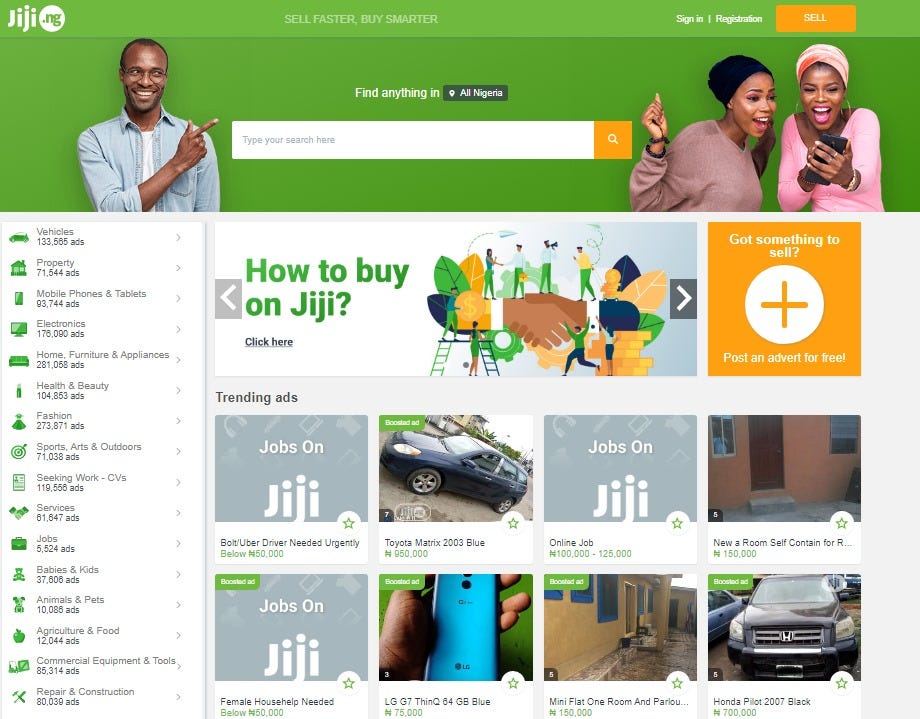

This online marketplace helps you buy and sell goods easily without middleman hassles.

🚨 ICYMI: We’re putting together the State of Marketing in African Tech Report, covering SaaS, FinTech, Web3, Healthtech, Edtech, HRtech, Agritech, Ecommerce, Energytech, Marketplaces, Entertainment Tech, Creators, and Agencies.

If you work in these industries, please share your insights via this 5-minute survey (and receive one-year subscriber access to 50+ Product & Growth marketing templates from the MIA Resources & Template Library).

The “Why” Behind Jiji

Jiji was founded in 2014 by Anton Volianskyi and Vladimir Mnogoletniy, two Ukrainian entrepreneurs who saw an untapped opportunity in Nigeria’s digital economy. At the time, online shopping across the continent was still at an early stage. While some platforms were trying to build structured e-commerce systems around warehouse and delivery, many ordinary people simply wanted a straightforward way to buy and sell directly.

Meanwhile, everyday Nigerians were already buying and selling at scale, just not online. In cities like Lagos, second-hand goods, electronics, cars, and even properties were constantly changing hands, but the process was sort of scattered.

For instance, if you needed to offload a used phone, you could tell a friend or flag down a dealer. There was no single platform designed for that need at scale, hence the poor visibility. Even renting an apartment often depended on chance conversations, as people relied heavily on word of mouth. In other words, commerce was happening, but it was scattered, unstructured, and, most importantly, hard to trust.

This was the landscape Anton Volianskyi and Vladimir Mnogoletniy walked into. They saw that Nigerians needed a trusted digital marketplace—a classifieds platform built for local realities, where anyone could list products and services for free, reach thousands of people instantly, and handle transactions on their own terms.

Classifieds are short, categorized advertisements—traditionally in newspapers and now online—used to buy, sell, or promote goods, services, and opportunities.

According to Anton Volianskyi:

“We identified a need for a platform where people could connect directly to buy and sell everything, from products to services. At the time, the market faced pressing issues around accessibility, affordability, and trust, with scams creating distrust in online transactions. To address this, we built Jiji to minimise the risks by facilitating direct transactions with no intermediaries.”

Crucially, that thinking shaped everything Jiji did in the early years. The platform had to be easy enough for anyone with a smartphone to use. And buyers had to also know they were dealing with real people, not faceless accounts. And so, it was this attention to context, not just technology, that made Jiji resonate.

Building and Launching the Product

When Jiji launched in Lagos in 2014, it wasn’t with an aim to become a full-stack e-commerce shop. Instead, the team leaned into a simpler idea: build a classifieds marketplace that worked like the markets people already used—only faster and more visible.

Initially, Jiji focused on lowering friction for sellers. For instance, it offered free listings for first-time users, a move that rapidly seeded inventory and gave newcomers a no-risk way to try the platform. At the same time, the team pursued distribution partnerships—striking deals to preinstall the Jiji app on affordable phones and even working with telecom operators for better access for mobile users, which helped drive early user adoption.

Equally important was trust. By focusing on density (lots of listings and buyers in concentrated cities) and reliability (fewer scams, clearer buyer–seller signals), Jiji built network effects that later made geographic expansion easier and more defensible. The goal of making Jiji a trusted space for peer-to-peer trading shaped many early product decisions.

The company then accelerated growth through selective acquisitions, notably taking over several OLX Africa operations, which increased market share in key countries and consolidated listings under the Jiji brand.

The goal of making Jiji a trusted space for peer-to-peer trading shaped many early product decisions.

In short, Jiji’s launch worked because it stayed practical. People in Nigeria were already buying and selling offline, so the team focused on making those same trades easier and safer online. Free listings brought sellers in, telco and device partnerships opened the door to first-time internet users, and fraud checks gave buyers confidence.

Achieving Product-Market Fit

For Jiji, product-market fit came from solving a very real frustration: people wanted to trade goods online, but they didn’t trust the platforms available at the time. By keeping listings free and focusing heavily on fraud prevention, Jiji quickly became a safer alternative to newspaper classifieds and informal Facebook groups.

The response was almost immediate. Sellers found that Jiji helped them reach far more buyers than they could offline, while buyers gained the confidence to browse without worrying as much about scams. This balance created the kind of two-sided trust every marketplace needs. By 2018, Jiji had already become one of the most visited classifieds sites in Nigeria, attracting 8 million monthly users.

Beyond the statistics, individual success stories made Jiji’s impact visible. Small business owners who once struggled to reach customers began to thrive on the platform. For instance, many car dealers in Lagos started using Jiji as their primary sales channel, with some moving most of their inventory online instead of relying on physical lots.

👉🏽 Join the Marketing In Action WhatsApp Community where MIA Newsletter subscribers network, and gossip (what’s trending).

Go-To-Market Strategy

When Jiji penetrated the Nigerian market, the biggest question wasn’t whether people wanted to trade; they already did that every day in open markets, roadside shops, and word-of-mouth deals. The real question was: how do you convince them to trust an online platform enough to do the same thing digitally?

The team’s first answer was accessibility. One of the smartest moves early on was to make listings free. This lowered the barrier for small traders, mechanics, real estate agents, and even individuals trying to sell used electronics. Within months, Jiji’s site was filled with diverse listings, which in turn attracted buyers. The classic marketplace flywheel (more sellers bringing more buyers) began to spin.

Partnerships also played a big role in this adoption. Deals with smartphone makers and telecom operators gave Jiji direct access to first-time internet users, many of whom had never bought or sold online before. In 2016, Jiji landed a partnership deal with Airtel, allowing users to access the platform without using mobile data.

Through partnerships with smartphone manufacturers and telecom providers, Jiji pre-installed its app on budget Android devices. That meant someone buying their first phone in Ibadan or Kano often discovered Jiji before they even opened Facebook.

Marketing was also designed for the local context. Instead of chasing early adopters in elite circles, Jiji leaned into mass-market advertising. They ran outdoor campaigns, television ads, and radio spots in multiple local languages. They leveraged aggressive marketing to the point where, for many first-time internet users, “buy it online” became synonymous with “check Jiji.” This approach helped Jiji cut across demographics, positioning itself as a marketplace “for everyone,” not just the tech-savvy few.

And finally, there was trust. At the same time, they invested heavily in education and reassurance. For Jiji, this was about reassuring users that online trading was safe. Safety guidelines, clear in-app reminders, and a heavy focus on scam prevention became part of the company’s outward messaging. And so, in a market skeptical about online trading, this messaging helped Jiji differentiate itself as the safer, more reliable option.

User Base and Revenue

In 2019, Jiji acquired OLX Africa and took over its operations in Nigeria, Kenya, Ghana, Uganda, and Tanzania. The bet on free listings and mass visibility paid off, with the platform crossing over 300,000 ads within its first few years, with millions of monthly visits driven by people searching for everything from cars to electronics.

Overnight, it consolidated two of the largest classified marketplaces on the continent, bringing in OLX’s existing users and listings. This acquisition not only expanded Jiji’s footprint but also gave it the scale to compete against global players like Facebook Marketplace.

Today, Jiji reports over 12 million monthly users and 4 million active listings across its markets. In Nigeria alone, the company is among the top three most visited e-commerce platforms, competing for traffic with Jumia and Konga. Its core categories, such as vehicles, real estate, and electronics, continue to drive the bulk of activity.

On revenue, Jiji follows a freemium model. Most listings are free, but sellers who want better visibility can pay for premium packages such as Top Ads or VIP Ads. This tiered system lets Jiji monetize its most active users—car dealerships, property agents, and high-volume merchants, while still keeping the platform accessible to everyday sellers. In 2021, the company reported that its paid advertising model was profitable, a rare milestone for consumer internet startups in Africa.

Fundraising Efforts

Jiji’s ability to scale from a scrappy startup into a pan-African marketplace has been shaped by carefully timed fundraising rounds and acquisitions that gave it the firepower to expand.

The company’s earliest backing came from Genesis Group, a Ukrainian investment firm that provided seed funding to get the idea off the ground in 2014. This early support helped Jiji set up its Lagos base, build its tech stack, and begin the long work of customer education around online classifieds.

Jiji’s next major milestone came in 2019, when it announced the acquisition of OLX’s businesses in five African markets—Nigeria, Ghana, Kenya, Tanzania, and Uganda. While the terms weren’t disclosed, reports suggest this deal was backed by fresh funding and strategic support from Genesis, giving Jiji a sudden leap in scale.

In 2021, Jiji raised a significant round from Digital Spring Ventures, a Moscow-based venture firm, marking a pivotal moment for its expansion strategy. This capital was used to acquire Cars45, an automobile trading platform, strengthening Jiji’s dominance in the vehicles category, one of its most lucrative verticals.

Most recently, in 2024, the company announced another round of funding, though the amount remained undisclosed. What was clear, however, was the intent: doubling down on safety features, AI-powered fraud detection, and user trust systems, areas critical to sustaining growth in Africa’s high-risk digital economy.

What’s Next for Jiji in 2025?

After more than a decade in the classifieds business, Jiji has grown into one of Africa’s most recognizable digital marketplaces. But the real question is how it plans to stay ahead in 2025 and beyond, a period where consumer expectations, competition, and regulation are shifting rapidly.

One clear focus is deepening trust and safety. Online fraud remains one of the biggest concerns in Africa’s e-commerce space, and Jiji has already invested heavily in AI-powered moderation and fraud detection tools. In 2025, the company is expected to push even further here, doubling down on identity verification and safer payment systems to ensure users can transact with confidence.

Another priority is expanding its automotive and real estate categories, which are among its highest-revenue drivers. With the successful integration of Cars45, Jiji now has an opportunity to own the entire customer journey for car sales, from listing to inspection to purchase. Real estate, meanwhile, remains a fragmented but lucrative vertical, and Jiji’s scale gives it a strong position to dominate.

Jiji’s core categories; vehicles, real estate, and electronics, are its highest-revenue drivers.

Geographically, Jiji is also looking beyond its current footprint. While it operates in five African markets today, Pan-African expansion remains a logical next step. Markets like South Africa, Egypt, or francophone West Africa present untapped opportunities, though each comes with unique challenges around language, regulation, and logistics.

Finally, there is the question of monetization. Jiji has historically kept its platform free for buyers and sellers, relying on premium listings and ad placements for revenue. In 2025, the company may experiment with new revenue streams, including transaction fees on high-value categories and partnerships with financial services that facilitate seamless buying, selling, and paying on the platform.

Jiji’s next chapter will likely be defined by two things: building deeper trust with users and finding smarter ways to monetize its massive base of buyers and sellers. If it succeeds, it won’t just remain a classifieds leader but also solidify its position as Africa’s premier digital marketplace.

☝🏽 A personal note:

I’ve mostly used Jiji for benchmarking—comparing the prices of commodities in the local markets when I either want to sell my own items (electronics and furniture) or buy other items.

I believe it’s a platform that really shines when you want to cut out the middleman. Their major challenge is a normal human challenge where commerce is involved: fraud. Still, with a bit of caution, it remains one of the most convenient ways to trade locally.

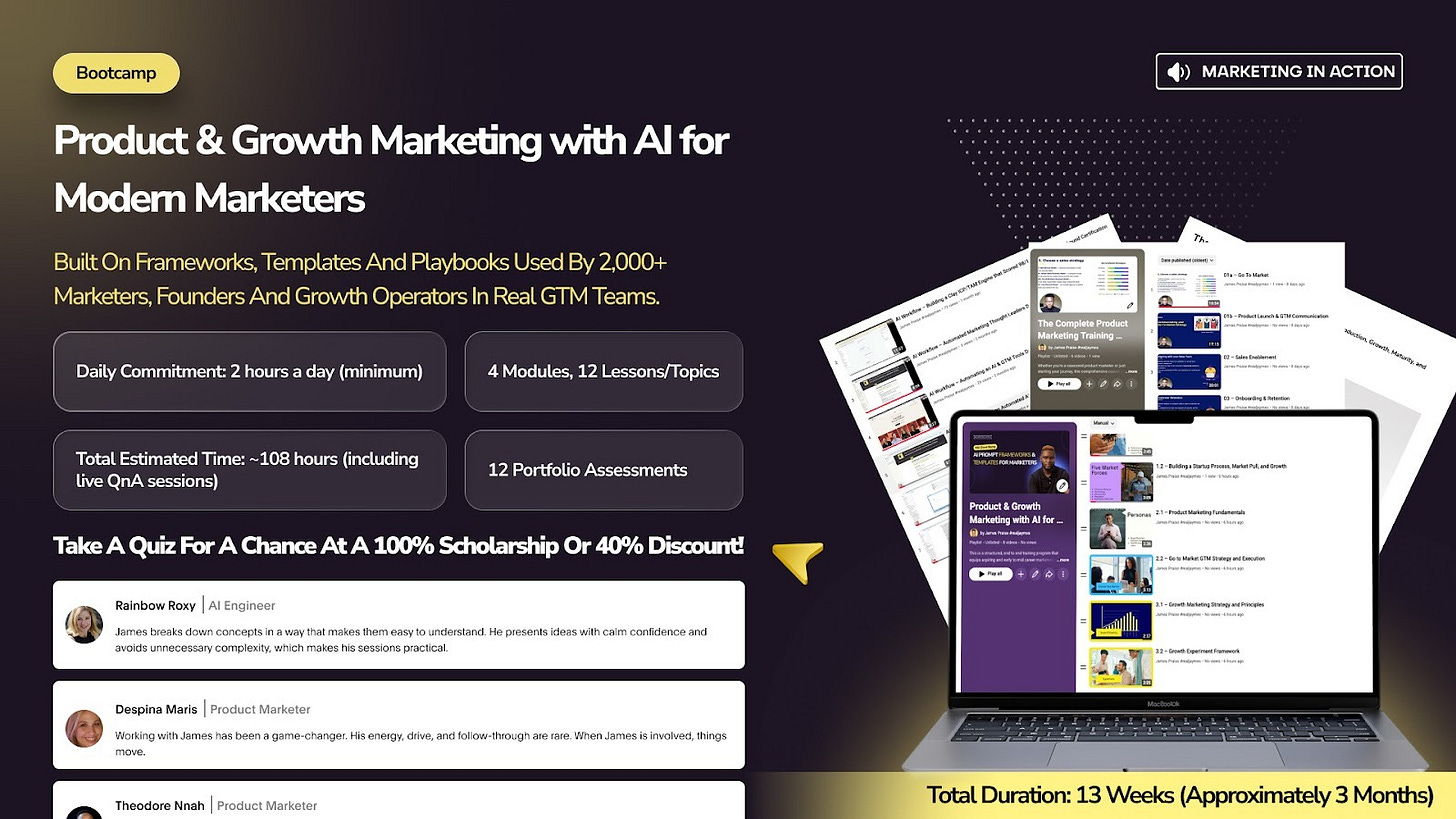

🎓 Learn how marketing actually drives growth, then do the work.

Join the 13-week, execution-first bootcamp where growth stories are translated into practical skills used by 2,000+ marketers across product marketing, growth, lifecycle, performance, and applied AI by shipping real work, not watching theory.

f you want to collaborate or feature your product in this newsletter, check out our media kit, and shoot me an email.

We’re building a village of 5,000+ marketers and founders who want to increase their odds of succeeding at marketing. Share this newsletter with them.