How Tosin Eniolorunda (Moniepoint) Built a Unicorn Fintech with a POS Machine

Moniepoint is an all-in-one business banking platform that helps African entrepreneurs manage payments, access credit, and grow with ease.

🚨 ICYMI: We’re putting together the State of Marketing in African Tech Report, covering SaaS, FinTech, Web3, Healthtech, Edtech, HRtech, Agritech, Ecommerce, Energytech, Marketplaces, Entertainment Tech, Creators, and Agencies.

If you work in these industries, please share your insights via this 5-minute survey (and receive one-year subscriber access to 50+ Product & Growth marketing templates from the MIA Resources & Template Library).

The "Why" Behind Moniepoint

Before Moniepoint became a household name, it was TeamApt—a company founded in 2015 by Tosin Eniolorunda and Felix Ike to fix broken digital systems within Nigeria’s banking ecosystem. Tosin, a former Interswitch engineer, had grown frustrated with the inefficiencies he witnessed across financial institutions. He knew software could do more, not just for banks but for the people banks served.

The team started by developing backend software to automate and digitize banking services. But the deeper they dug, the more visible an opportunity became: banks weren’t just inefficient—they were inaccessible to millions. A new “why” emerged, and it would go beyond simply empowering banks to empowering the people they failed to reach—SMEs, merchants, and underserved Nigerians.

The team set out to even the odds by giving businesses and individuals across Nigeria access to the tools they needed to grow — banking, payments, credit, and business management — all in one place. At the time, a large portion of the population was underserved, shut out of traditional financial systems that favoured low-risk clients and urban centres. Moniepoint saw a different future: one where everyone, no matter their location or income level, could access reliable, empowering financial services.

“Driven by the goal of spreading financial happiness, I couldn’t ignore how much financial inclusion in Nigeria needed to improve. Most of the ‘big guys’ supported the people with little risk, but this meant so many others were left underserved. Agency banking was the obvious bridge, bringing digital financial services closer to the people who needed them most. But problems like reconciliation errors, system instability, and lack of transaction transparency made adoption difficult. Agents were often left to deal with dissatisfied customers, and the model was struggling to scale and so we built a product that would solve these problems, effectively changing the trajectory of agency banking.” – Tosin Eniolorunda, Moniepoint’s CEO.

Up until this time, Moniepoint was viewed merely as a TeamApt product. Its widespread presence rendered TeamApt nearly invisible.

“Despite these milestones, we had a bit of a problem. We had struggled with our brand for a bit. Having built a name while creating solutions for banks, and then gone ahead to build successful products like Moniepoint and Monnify, which served businesses, people often couldn’t reconcile us with these products. The name “TeamApt” was disconnected from these products, and describing ourselves was a big challenge”, says Tosin.

So, when TeamApt’s Global Marketing Lead shared her proposal to adopt the flagship product name, Moniepoint, with the executive team, there was minimal hesitation in accepting it. The timing was ideal. By January 2023, TeamApt Inc. had changed its name and officially became Moniepoint Inc.

“Moniepoint was the product that people knew and loved. It made sense for the company to become known by the name of this product with which we were heavily associated,” - Tosin Eniolorunda.

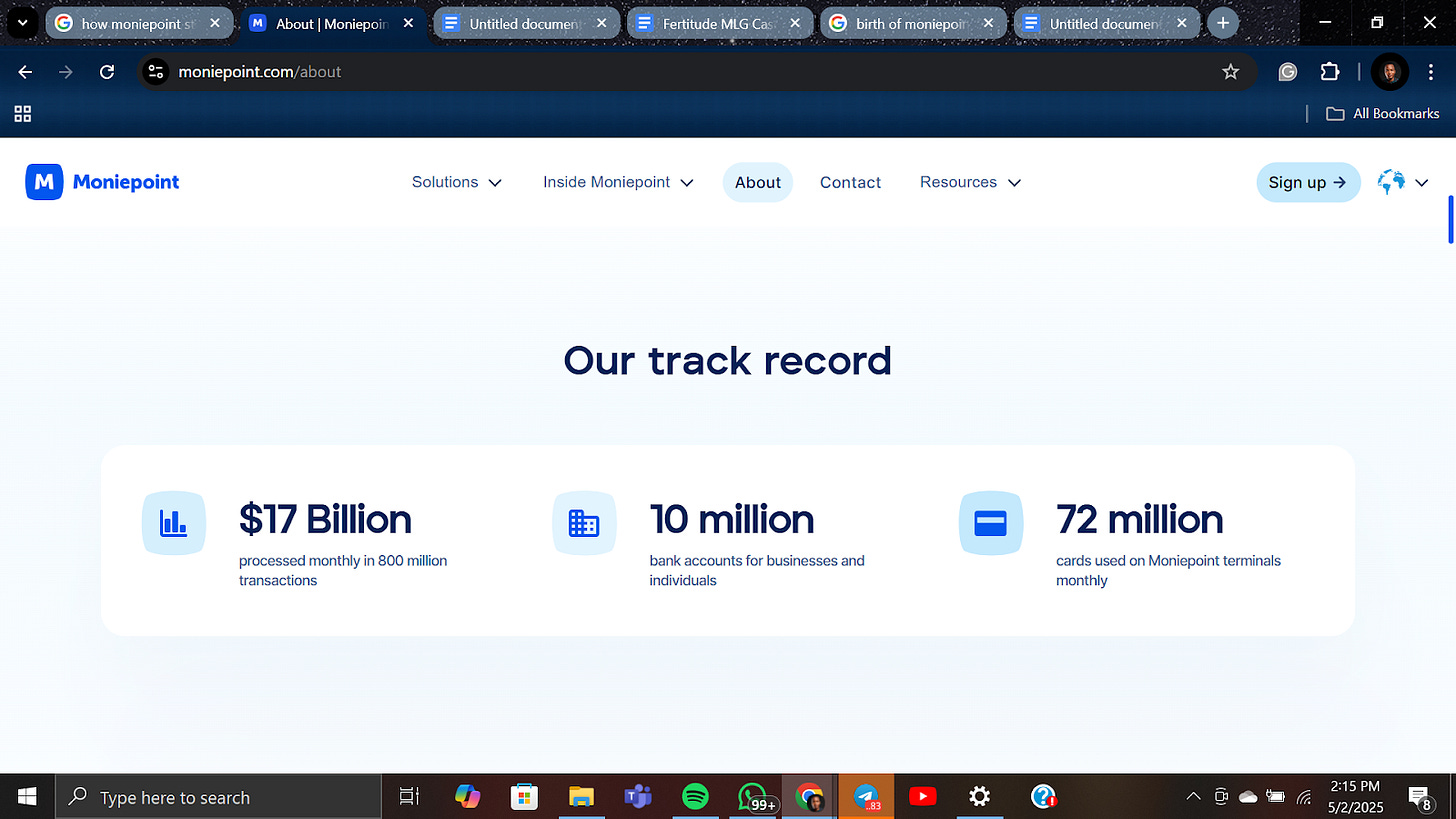

Moniepoint swiftly became a sought-after solution. Its mission, though simple, is powerful: to create a society where everyone experiences financial happiness. Today, Moniepoint is an all-in-one banking, credit, and cross-border payment solution for African businesses and their customers. Two out of three adults in Nigeria have experienced reliable payments with Moniepoint, and it is Africa's fastest-growing fintech.

Building and Launching the Product

While working closely with financial institutions, the TeamApt team uncovered a persistent pain point: PoS reconciliation. Merchants were struggling with transaction clarity, often unable to identify which customer made which payment. In response, TeamApt built a PoS acquiring solution in 2016 to address this inefficiency. It wasn’t just a fix—it was a game-changer. By 2018, 26 out of Nigeria’s 30 banks were using the product. The breakthrough moment came when Fidelity Bank chose TeamApt’s software over that of the industry giant, Interswitch. Wema Bank followed. Then others. By initially offering the software for free, TeamApt created real-world use cases that proved its value—paving the way for long-term institutional contracts.

In 2019, the company launched Moniepoint as a separate product—a mobile money agent network designed to give everyday Nigerians more control over their finances. That same year, they secured $5.5 million in Series A funding from Quantum Capital. By 2020, Moniepoint extended its offering to include PoS terminals, empowering agents to deliver banking services in underserved and remote communities. Moniepoint quickly became Nigeria’s most robust financial services distribution network, processing over 120 million transactions per month, amounting to more than $7 billion monthly. In regions where traditional banking had failed, Moniepoint became the go-to infrastructure for financial inclusion.

Still, the team remained grounded. Instead of aggressively chasing funding, Tosin and his team bootstrapped, starting with ₦15 million from Tosin’s personal savings and a handful of side projects. Their philosophy was simple: build something of undeniable value, and the investors will come. In 2022, Moniepoint evolved again—this time expanding to support all types of small businesses. With a banking license in hand, the company began offering full-service banking solutions to help businesses thrive, from payments and loans to compliance and beyond.

By 2023, Moniepoint had earned the trust of over 1.5 million businesses, many of which have since become deep, long-term users of its products. The brand has established itself as a foundational growth engine for entrepreneurs and SMEs across Nigeria, achieving unicorn status in October 2024.

Achieving Product-Market Fit

“Right off the bat, we decided that we wouldn’t just build, but we would do so differently. Armed with industry experience and market research, we built a product that would solve these problems, effectively changing the trajectory of agency banking”, - Tosin Eniolorunda, CEO of Moniepoint.

For Moniepoint, product-market fit wasn’t about buzzwords. It was visible in street kiosks, markets, and rural towns. A key part of their strategy was targeting the informal sector, which employs the majority of Africa's workforce, has historically been underserved by conventional financial institutions. Moniepoint’s strategy has helped to change this narrative. By 2021, over 30,000 agents were facilitating 23 million transactions monthly, valued at ₦400 billion.

The numbers exploded. In 2022, they processed an annualised total payment volume exceeding $170 billion. By 2023, that number ballooned to $150 billion in transactions processed within the year. And crucially, Moniepoint wasn’t just processing payments—they were solving business problems.

Tosin once said: “We realised that while we solved the payment problem, businesses still struggled with operations, taxes, insurance, and staff welfare.” The product evolved. Moniepoint became more than a payment terminal—it became a full business bank.

With a microfinance license from the NDIC, they began offering credit, insurance, and operational tools. Loans disbursed reached $1.4 billion with a default rate of less than 0.1%. Among other things, the brand added another leg to the transaction process flow that allowed agents to get real-time reports of their transactions. It also built a hyperlocal distribution network, powered by a system that ensured agents could see and track how much they earned. This combination made even the earliest version of Moniepoint something that people were excitedly waiting for.

👉🏽 Join the Marketing In Action WhatsApp Community where MIA Newsletter subscribers network, and gossip (what’s trending).

Go-To-Market Strategy

TeamApt’s early go-to-market approach was unconventional—but brilliant. Instead of pouring funds into aggressive marketing, they leaned on product-led growth. As a B2B solution, they kept spending minimally and focused on showing banks the problem, then offering the solution, free. This not only built trust but created traction faster than any ad campaign could.

But the pivot to B2C with Moniepoint demanded a different playbook—one that could scale.

They found it through their agent network. Word-of-mouth among merchants, powered by reliable tech and exceptional customer support, fueled widespread adoption in places marketing rarely reached.

In 2021, the journey to define Moniepoint’s unique brand voice began with Didi, VP of Comms, who laid the foundation for a cohesive product and creative strategy. Working alongside Chinedu (Product) and Yemi (Creative), the team crafted a brand promise rooted in daily relevance.

Moniepoint wasn’t trying to be aspirational—it was built for real life. Whether it was buying sachet water, garri, sugar, or movie tickets, the brand wanted to show up. That ubiquity demanded a brand language that was simple, human, and resonant.

“It wasn’t about us—it was about them. Whatever fancy work had gone into our product didn’t matter. They just needed to know how we solved their problems” – Victory Okoyomoh, Senior Comms. Specialist, Moniepoint.

Tosin aligns with this philosophy, mentioning how an offline marketing strategy is of high importance in a very low-trust business environment like Nigeria, “We’ve seen people say they want to know who’s behind the brand and want some comfort that it’s not some anonymous folks they are dealing with online. There is also an emotional connection, rooted in trust, which is still important in banking and is one of the key distinctive elements for attracting and retaining customers. So, the offline strategy does have a lot of merit in a society like ours to provide the well-needed assurances that their monies are safe and secure, and they are dealing with a reputable institution.”

Under this philosophy, brand marketing focused on three core objectives:

1. From reliability to relatability: If people could relate to Moniepoint, they’d trust it. If they trusted it, they’d rely on it.

2. Alignment of product and brand: Every touchpoint had to say: “That’s Moniepoint. It works, it makes sense, and it speaks my language.”

3. Memorable, not just marketable: The team struck a balance between polished visuals and content that genuinely entertained. The goal? Be remembered because you were understood—and enjoyed.

User Base and Revenue

Today, Moniepoint serves over 1.6 million merchants, enabling transactions worth trillions of naira. In 2023 alone, it processed over $150 billion in total transactions. In the same year, it was ranked the second-fastest growing company in Africa by the Financial Times.

Behind those figures lies disciplined execution. The company was profitable within its first two years. Revenue—measured in USD—was always ploughed back into growth. That mindset helped them grow revenue by over 4,500% across three years.

They’ve now extended their offering to include payroll management, staff welfare, and even insurance, all tailored for the 41 million small businesses across Nigeria.

Fundraising Efforts

Moniepoint’s fundraising journey is a study in timing. They bootstrapped for four years, building value before raising their first round. That came in 2019, with a $5.5 million Series A. By 2021, they’d attracted interest from Novastar Ventures and Lightrock, closing a Series B of over $30 million. QED Investors led the pre-Series C round with an additional $50 million.

But the tipping point came on October 29, 2024. Moniepoint announced a $110 million Series C led by Development Partners International and Google’s Africa Investment Fund, officially becoming Africa’s newest unicorn. This capital injection positions Moniepoint to scale aggressively across Africa. According to Tosin, the funds will accelerate the development of their integrated platform, making it easier for businesses to thrive on the continent.

What’s Next for Moniepoint in 2025?

The unicorn title isn’t the finish line—it’s a milestone. Moniepoint is now focused on three things:

Pan-African Expansion: With a proven model in Nigeria, they're eyeing similar pain points across Ghana, Kenya, and francophone Africa.

All-in-One Platform: They want to consolidate banking, payments, loans, insurance, and HR tools into one dashboard for African SMEs.

Deeper AI & Data Insights: Tosin hinted that using data to create predictive financial tools is part of their 2025 roadmap. The goal? Help SMEs make smarter business decisions.

☝🏽 A personal note:

As someone who’s led marketing at different levels for various organizations, bootstrapped or funded, and often as the first marketing hire at these places, I’ve come to deeply respect brands that choose to build slowly, intentionally, and with clarity of purpose.

That’s why Moniepoint’s journey resonates. From Tosin Eniolorunda’s early days designing infrastructure at Interswitch to building what now powers over two-thirds of Nigeria’s retail payments, this wasn’t just execution—it was vision meeting discipline.

Moniepoint didn’t chase virality or vanity metrics. It earned trust. It scaled impact. And it did so with the user at the centre, not the spotlight.

In an industry where everyone’s sprinting, they walked—and still made it to unicorn status.

As Tosin once said: “It’s better to prove that you have value first, then come back to place demand on that value.”

If you’ve ever had to build from scratch, you know how rare that kind of patience is. Africa, take note.

We recommend Moniepoint for any entrepreneur or business owner seeking reliable, relatable, and deeply accessible banking solutions designed for real-world challenges.

🎓 Build modern product marketing and growth skills with AI.

Join the 13-week, execution-first bootcamp built on frameworks, templates, and playbooks used by 2,000+ marketers and founders in real GTM teams. Learn product marketing, growth, lifecycle, performance, and applied AI by shipping real work, not watching theory.

If you want to collaborate or feature your product in this newsletter, check out our media kit, and shoot me an email.

We’re building a village of 5,000+ marketers and founders who want to increase their odds of succeeding at marketing. Share this newsletter with them.