PiggyVest’s Playbook: How a Viral Tweet Led To Over ₦2 Trillion in User Payouts

This savings app helps you build better money habits so that you can achieve financial freedom.

🚨 ICYMI: We’re putting together the State of Marketing in African Tech Report, covering SaaS, FinTech, Web3, Healthtech, Edtech, HRtech, Agritech, Ecommerce, Energytech, Marketplaces, Entertainment Tech, Creators, and Agencies.

If you work in these industries, please share your insights via this 5-minute survey (and receive one-year subscriber access to 50+ Product & Growth marketing templates from the MIA Resources & Template Library).

The "Why" Behind PiggyVest

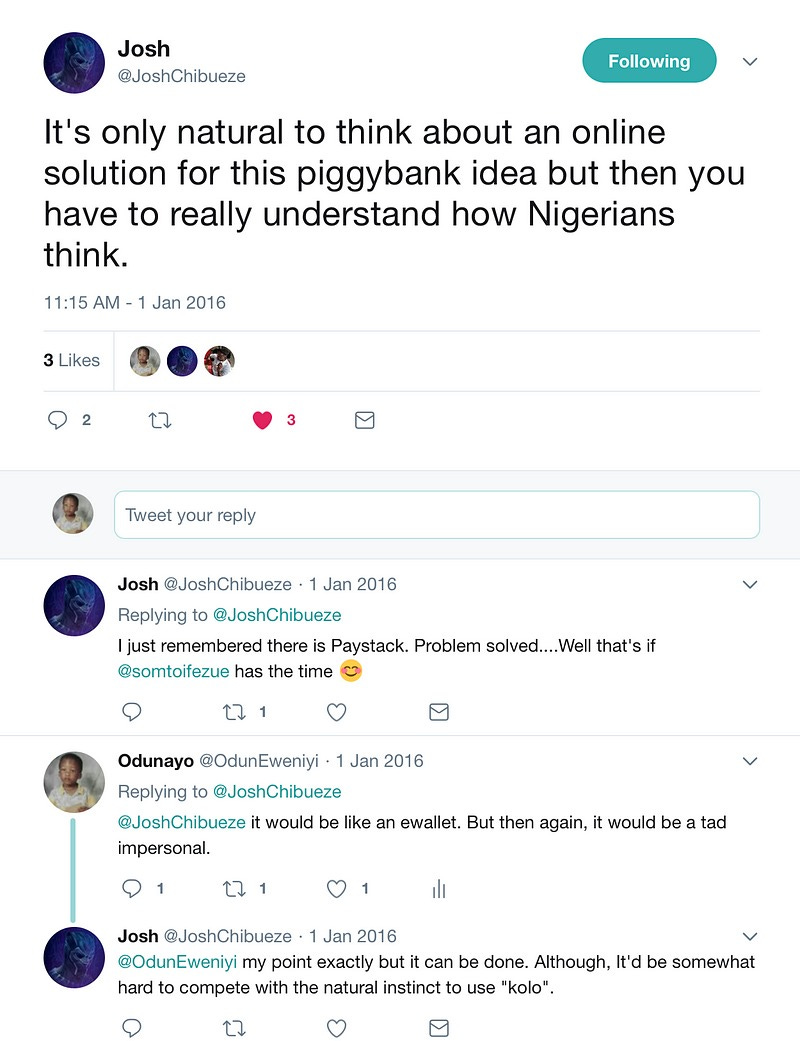

PiggyVest was founded in 2016 by Odunayo Eweniyi (COO), Somto Ifezue (CEO), and Joshua Chibueze (CMO) with one mission: to help Nigerians build a healthy saving culture in a country where access to reliable savings tools were limited. The idea was sparked by a simple question—Why was it so hard for young people to save consistently and meet their financial goals?

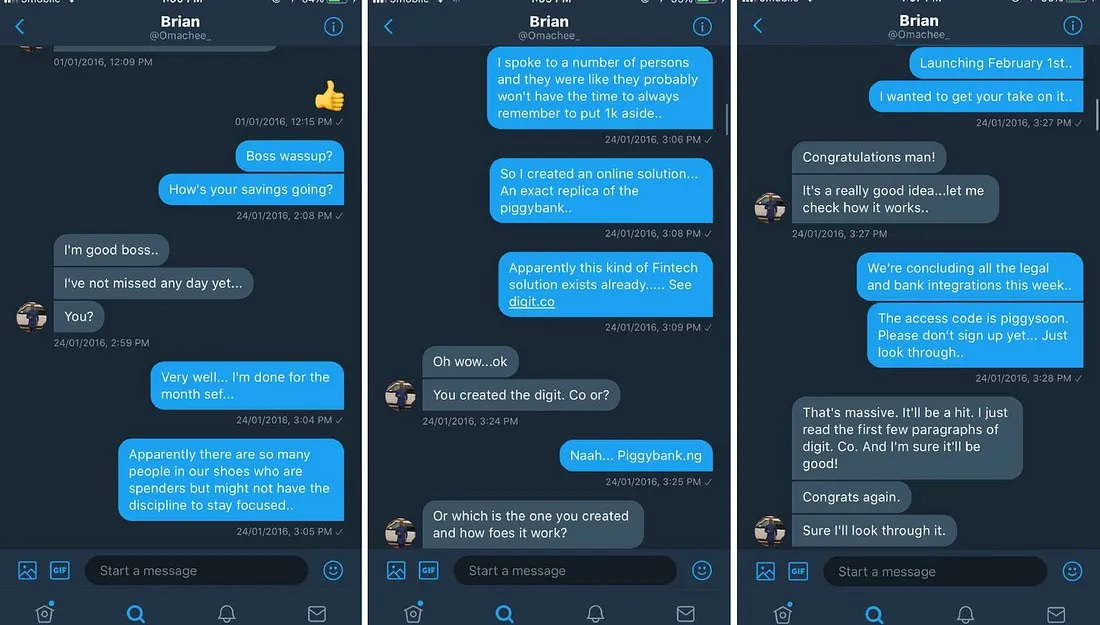

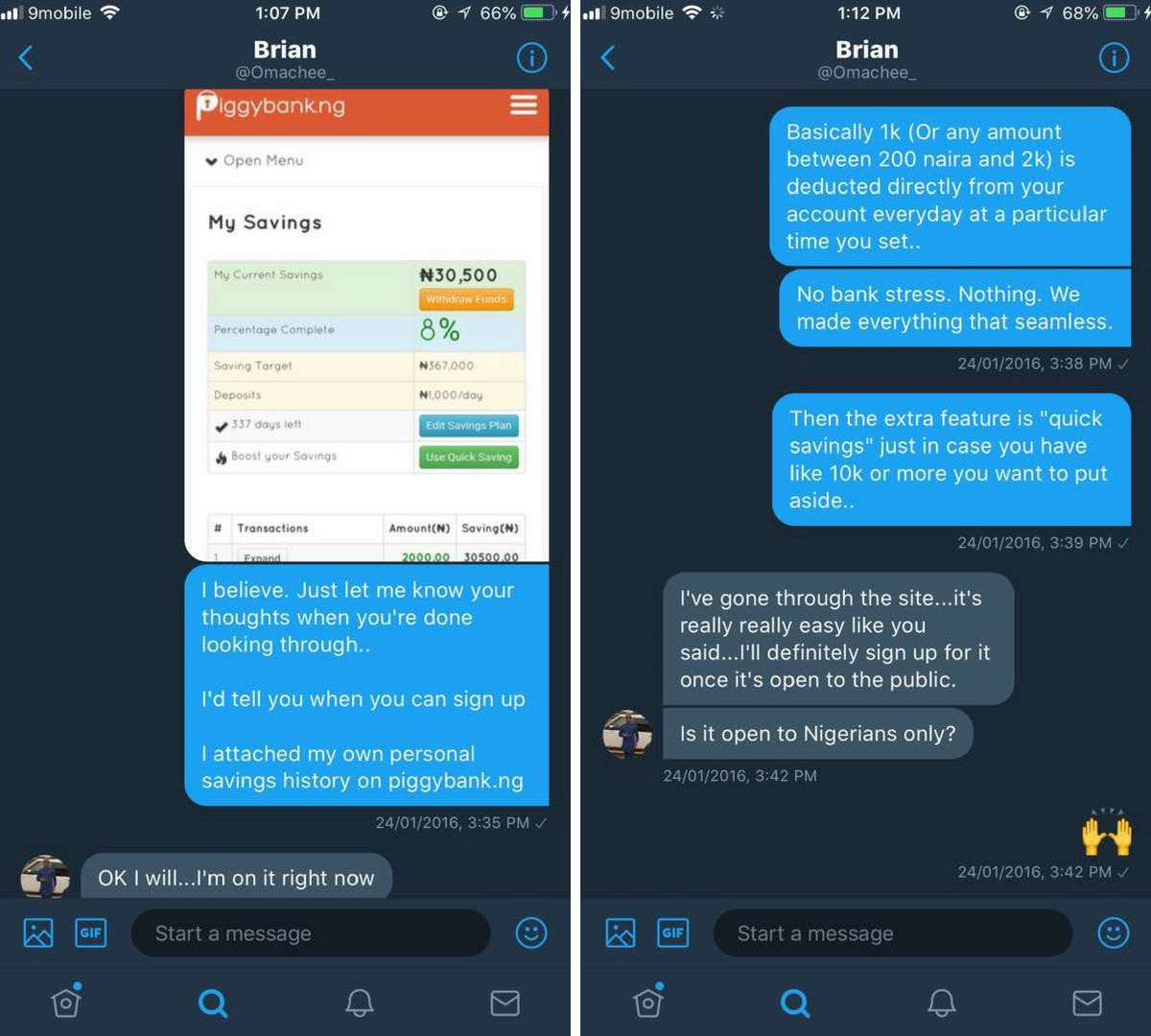

Before PiggyVest, the team ran PushCV, a platform helping Nigerians find jobs. But they noticed a deeper problem—even when people got jobs, many struggled to manage money. Inspired by a viral tweet about automating savings through a wooden box (kolo), they realized technology could offer a smarter, more disciplined way to save.

On the 31st of December, 2015, a Twitter user shared a picture of her saving box and how she was able to save N365,000 by putting aside N1,000 every day.

“We saw people saving in wooden boxes or relying on informal means. We thought – what if we built a digital version of that, with structure, security, and returns? That was the starting point.” – Odunayo Eweniyi

One of the co-founders, Joshua, was so inspired by the tweet that he immediately bought a kolo, echoing the nostalgia and shared financial struggles many Nigerians face. Around the same time, another Twitter user began selling savings boxes for ₦2,000, demonstrating a clear public interest in saving mechanisms that were tangible, relatable, and culturally relevant.

This laid the foundation for an idea: what if the "kolo" could be digitized? The team quickly recognized that while the physical savings box was symbolic and familiar, it came with major drawbacks—lack of security, low discipline, and easy access that made it difficult for users to stick to long-term savings goals. Thus, Piggybank.ng was born—an MVP designed to automate the "kolo" experience while addressing its key limitations.

Building and Launching the Product

The team didn’t jump into app development right away. Instead, they focused on proving one thing: that Nigerians, especially millennials, were ready to save digitally if the tool was simple, trustworthy, and transparent.

The first version of Piggybank.ng was developed in a matter of days and immediately began evolving through continuous iterations. The team explored different monetization models—charging a flat monthly fee of ₦490, then switching to transaction-based fees on deposits—both of which were quickly discarded. Eventually, they settled on making the platform entirely free for users, introducing a smart constraint: limited withdrawal frequency.

This not only encouraged users to develop better saving habits but also allowed the company to make more informed financial decisions down the line. At the time, the team wasn’t sure how to monetize the product, but they believed deeply in its potential impact. Build it well, they thought, and the users will come.

A significant enabler in those early stages was Paystack, which had just launched and provided the much-needed payment infrastructure. Their support was instrumental to the product’s viability and growth.

Getting the first user, however, proved to be its own challenge. Why would anyone trust a new product over their traditional banks, which already offered convenience, familiarity, and some level of assurance? To test the waters, Joshua reached out to the same Twitter user who had initially sold him the wooden kolo. He pitched the digital version of that experience—Piggybank.ng.

That user, Abel Adejoh, became Piggybank.ng’s “user zero.” His enthusiasm and feedback became a turning point for the team, reinforcing their conviction that they were on to something meaningful. Though they asked him to keep his usage confidential until the official launch, his participation validated the product in a deeply personal and community-rooted way.

By April 2017, Piggybank.ng was rebranded to PiggyVest and launched a full suite of savings and investment features, including flexible savings plans, fixed targets, and interest payouts. What began as a humble MVP has grown into a full-blown fintech platform tailored to the real financial lives of young Nigerians.

Achieving Product-Market Fit

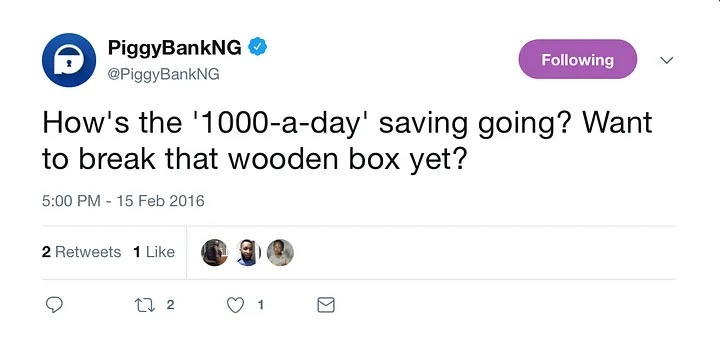

When Piggybank.ng launched, it was laser-focused on a very specific market: Nigerians who wanted to save ₦1,000 daily—mirroring the habits of wooden-box savers. The goal was to provide a digital alternative that still honored the discipline of incremental savings. The product began with just daily savings as its core functionality, and over time, weekly and monthly options were added in response to user needs.

The team’s initial target was small-scale savers working toward critical financial obligations such as rent, tuition, or seed capital for small businesses. It wasn’t about complex financial tools—it was about enabling consistent, manageable savings for people who needed a better, safer, and more disciplined option than the physical kolo.

From their very first tweet, the response was overwhelming. Within two days, Piggybank.ng had over 300 sign-ups. By the end of 2016, users had collectively saved ₦21 million—a milestone that led to a celebratory email sent to the entire customer base. It was a sign that the product was truly resonating.

The product stood out from traditional banks and thrift systems by offering flexible savings plans, reliable payouts, and visible interest growth. Word-of-mouth referrals and organic social sharing helped drive user acquisition. By the time they rebranded to PiggyVest, they had helped over 53,000 users save close to a billion Nigerian naira (£2,000,000).

Consistent user engagement, retention, and positive feedback throughout this early phase confirmed the product-market fit. PiggyVest had successfully built a digital saving experience that matched the needs and behaviors of its audience.

Go-To-Market Strategy

The product didn’t launch with grand marketing budgets or nationwide campaigns. Instead, it relied on virality, conversations around relatable financial habits, and direct engagement with its early adopters.

Piggyvest’s Twitter-led community marketing strategy helped drive massive organic growth and word-of-mouth adoption. The very first tweet announcing Piggybank.ng led to over 300 sign-ups within 48 hours, demonstrating how closely the idea resonated with real user behavior.

Strategic partnerships with fintech enablers like Paystack and Flutterwave were vital. These collaborations ensured seamless payment processing, simplified onboarding, and efficient payout flows, which were critical to maintaining trust—especially in a market where skepticism about digital finance was high.

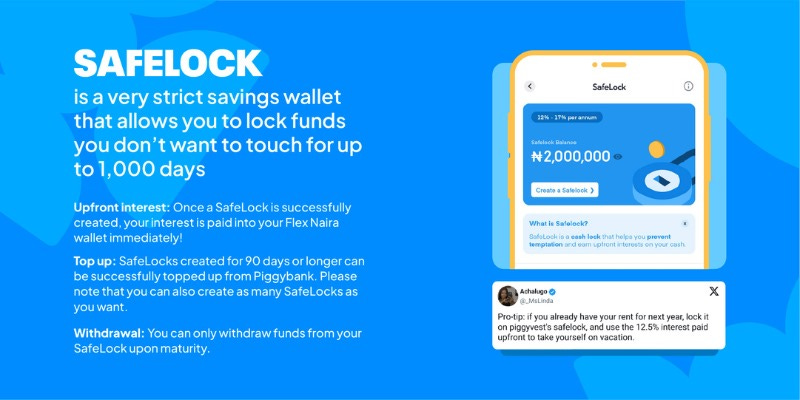

Product-led growth strategies were employed especially in April 2019, when Piggybank.ng rebranded to PiggyVest and introduced new features that extended its scope beyond simple savings. The launch was a turning point as the new Safelock feature became an instant hit, locking in millions of Naira in user funds within months.

Nine years on, PiggyVest has continued to innovate and deliver excellent service, cementing its position as Nigeria’s leading savings and investment platform.

“9 years ago, we had a mission to give everyone the power to manage and grow their finances. From the very first person who trusted us with their money to the millions of you who now call Piggyvest home, you have been at the center of this journey.” - PiggyVest Co-founders

From that pivotal launch moment, they’ve remained committed to simplifying personal finance and offering users even greater value with each new product update.

👉🏽 Join the Marketing In Action WhatsApp Community where MIA Newsletter subscribers network, and gossip (what’s trending).

User Base and Revenue

Today, PiggyVest stands as Nigeria’s leading digital savings and investment platform, serving over five million users. Since its inception in 2016, it has facilitated more than $1.25 billion (₦2 trillion) in payouts to users, underscoring its impact and scale.

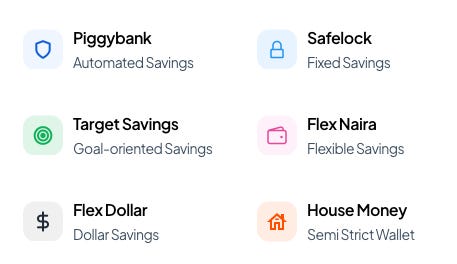

From humble beginnings focused on daily savings, PiggyVest has expanded its offerings into a full suite of financial tools. Today, users can access core savings through Piggybank, investment opportunities via Invest, fixed-term deposits with Safelock, goal-based savings through Target Savings, flexible withdrawals with Flex Naira, and dollar-denominated savings via Flex Dollar. These products have empowered young professionals, entrepreneurs, and students to build stronger financial habits, plan for long-term goals, and grow their wealth with greater flexibility.

PiggyVest’s revenue model is built around asset management partnerships and investment commissions, rather than charging users for basic features. This approach—combined with attractive interest rates, flexibility, and trust-driven design—has helped drive both adoption and long-term retention.

Its commitment to accessibility, financial literacy, and product innovation has not only cemented its leadership in the market but also played a pivotal role in shaping Nigeria’s broader fintech ecosystem. While specific revenue figures remain undisclosed, the platform's continued product expansion, growing user base, and massive payout volume are strong indicators of a sustainable and thriving business.

Fundraising Efforts

In 2018, PiggyVest raised $1.1 million in a funding round led by angel investors – its last major venture round to date.

Later in 2021, VFD Group, a Nigerian investment firm, acquired a 12% equity stake in the company. The deal was structured as a mix of cash investment and a merger with one of VFD’s competing products, further strengthening PiggyVest’s market position.

This early capital injection gave the team room to scale operations, build out its core savings infrastructure, and grow its user base.

Since then, PiggyVest has remained largely bootstrapped, focusing on building a solid, revenue-generating business rather than relying on repeated fundraising rounds. The company’s approach to sustainable growth, coupled with a strong product-market fit, has allowed it to thrive in Nigeria’s competitive fintech landscape without frequent capital raises.

What’s Next for PiggyVest in 2025?

In 2025, PiggyVest is planning to introduce a budgeting feature to help users manage their daily expenses and ensure their salaries last until the next payday. This new feature is part of PiggyVest's continued efforts to expand its offerings and help users manage their finances more effectively.

PiggyVest continues to focus on providing tools and services that empower users to take control of their finances.

We recommend PiggyVest if you're looking for a trusted, user-focused platform to save, invest, and now budget. It’s built for people who want better control over their money, without the hassle of complicated financial tools.

🧩 Put this case study into action.

Use our startup-tested templates for GTM, positioning, and growth. Explore the Marketing Toolkit Subscription.

20% off all MIA handbooks and templates when you use the code: MIA Community.

If you want to collaborate or feature your product in this newsletter, check out our media kit, and shoot me an email.

We’re building a village of 5,000+ marketers and founders who want to increase their odds of succeeding at marketing. Share this newsletter with them.